Fossil Fuels Prices Forecasts

In IEA’s scenarios, oil prices function as a balancing mechanism for global supply and demand, ensuring market stability. As such, the trajectories are smooth and show a sustained equilibrium, although in practice volatility and uncertainty are ever-present features of oil markets

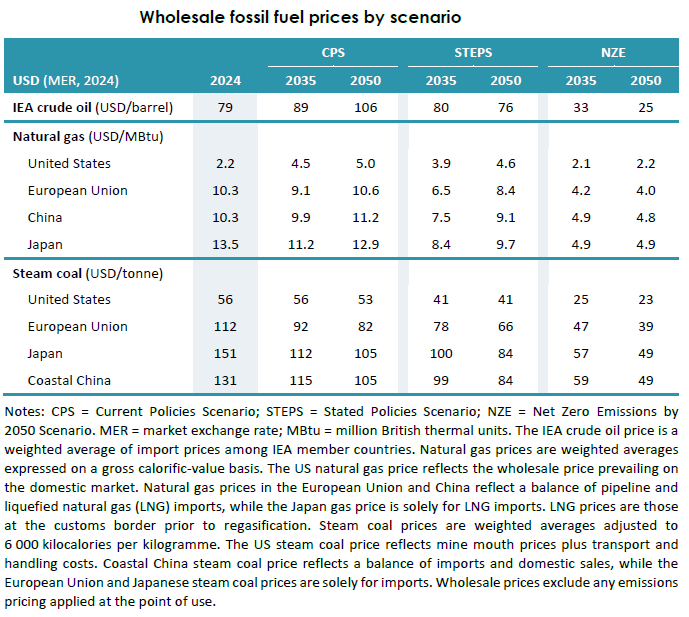

In the Current Policies Scenario, strong and sustained growth in oil demand leads to oil prices reaching USD 106/barrel in 2050 to incentivise the necessary production of resources. Market balances in this scenario depend on how major producers in different regions maintain high levels of production and how they manage their costs

In the Stated Policies Scenario, decreasing oil demand brings down the price at which markets find equilibrium, but high levels of investment are still required to compensate for declining output from existing fields and for the development of new resources. Prices remain around 2024 levels over the next decade and decrease modestly to 2050

In the NZE Scenario, robust policies are required to effectively neutralise any increase in demand that might result from lower prices, ensuring that climate objectives remain on track. In the NZE Scenario, oil prices fall to USD 33/barrel by 2035 and USD 25/barrel by 2050 as oil demand declines

In contrast to oil, there is no global natural gas price but rather a series of regional prices that are loosely connected by an increasingly liquid market for internationally traded gas, primarily in the form of LNG. Around 60% of LNG is currently delivered under long-term contracts with oil-linked pricing formulas or indexed to gas market prices: the remainder is traded on the spot market

IEA’s gas price benchmarks are weighted average prices that incorporate these different pricing methods. They represent an equilibrium between supply and demand that ensures that new projects come online in a timely manner and can cover their long-run marginal cost of supply. They also consider market conditions in the years ahead; in periods of ample supply availability, prices may for a period reflect the short-run marginal cost of supply.

The price of LNG in the European Union in 2035 in the STEPS is around USD 6.2 per million British thermal units (MBtu), based on the US Henry Hub price plus a 15% uplift, some capital recovery for LNG liquefaction terminals, variable shipping fees and a regasification charge. The oil-indexation price is just above USD 8/MBtu. Around 90% of gas in 2035 is priced on a gas hub-indexation basis and 10% on an oil-indexation level, meaning the weighted average gas import price is around USD 6.5/MBtu

Global gas trade is expected to continue shifting toward LNG. Over the period to 2030, around 300 billion cubic metres (bcm) of new LNG export capacity is set to come online, led by the United States, Qatar and Canada – the largest wave of global capacity additions ever. This will put downward pressure on prices over the coming years, but the impacts vary by scenario

In the CPS, the new supply is absorbed relatively quickly by robust increases in demand. With strong domestic demand growth and a surge in LNG exports, the United States sees its domestic gas price rise from USD 2.2/MBtu in 2024 to USD 4.5/MBtu in 2035; afterwards China, European Union and Japan also see modest price increases to 2050 driven by their increasing exposure to tightening LNG balances

In the STEPS, downward price pressures and a well-supplied global gas market remains into the 2030s

In the NZE Scenario, global demand and prices are both much lower throughout the Outlook period: they remain significantly below 2024 levels by 2035 as the rapid expansion of renewables and electrification limits gas demand growth, despite abundant LNG availability

As can be seen from IEA’s Table, Japan gas prices are expected to be $12.9/MBtu, $9.7/MBtu and $4.9/MBtu under CPS / STEPS and NZE scenarios respectively in 2050

Over time, demand for steam coal declines across all the WEO-2025 scenarios of IEA, which has implications for price trajectories

In the CPS, prices need to be high enough to maintain existing mines and incentivise the opening of new ones: this maintains prices at relatively high levels, although some major importers nonetheless see significant declines from current levels

In the STEPS, an earlier downturn in demand in China pulls down global prices more quickly

In the NZE Scenario, falling demand brings prices down to very low levels: higher cost mines are forced to close, and no new mines are needed. More than for any other fuel, the global trajectory for coal is determined by a handful of major consuming countries, notably China and India, whose consumption of coal for power generation accounts for nearly half of current coal use worldwide

As can be seen from IEA’s Table, coastal China coal prices are expected to be $105/tonne, $84/tonne and $49/tonne under CPS / STEPS and NZE scenarios respectively in 2050