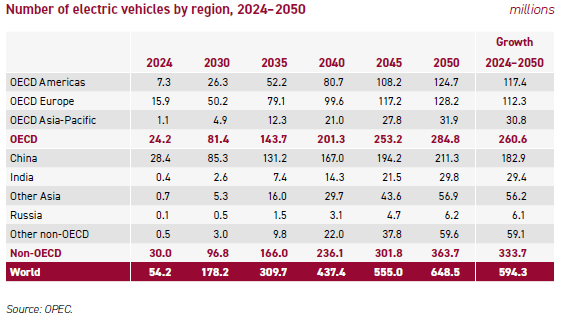

Region wise EVs Forecasts

(Source: OPEC`s World Oil Outlook to 2050)

The most widely covered topic in the transportation sector is the development and future role of EVs. On that OPEC has said, what is clear is that cost challenges remain, although mass production is providing benefits, with China, in particular, producing relatively low cost EVs for the global market

From the point of view of the technology, advancements in batteries are expected to continue to help push the range of EVs higher and over 500km over time. Other innovations are also set to gradually improve EV performance, charging time and safety, such as the application of solid-state batteries

Without breakthroughs in battery chemistries, however, the battery supply chain will continue to face massive challenges to supply the necessary critical minerals to meet demand for the two dominant battery chemistries today – nickel manganese cobalt and lithium iron phosphate

OPEC highlights that the electrification of road transportation has the most potential to significantly change the global fleet composition and, in turn, impact future oil demand. Therefore, monitoring technology developments, the investment plans of car manufacturers and consumer behaviour regarding the acceptance and cost competitiveness of EVs (including BEVs and plug-in hybrids), is a regular feature of their oil demand modelling

OPEC notes that new EV sales surpassed 17 million globally in 2024, which meant that their share in global vehicle sales increased from around 14% in 2023 to 18% in 2024. If passenger car sales alone are considered as a base, this share increased to 20% in 2024. However, OPEC highlights that this number becomes less impressive when considering that around 65% of EVs (11 million) were sold in China and almost 40% of new EVs were plug-in hybrids that still partly use gasoline as an energy source

This means that, except for China and a few European countries like Norway, Sweden and Netherlands, the penetration of EVs in both global and regional fleets is still very low. In most developing countries, the share is well below 1%, in OECD Americas it is slightly above 2% and in OECD Europe it is between 5% and 6%. Even in China, with its high share of EVs in new car registrations in 2024, their overall penetration was still less than 8% last year

Against this backdrop, the two key questions to ask are: how fast could this situation change in the years to come, and can the electrification of road transportation progress to levels that might materially impact oil demand?

Considering existing policy targets – such as a ban on the sales of ICE-based vehicles in the EU, the UK, Canada, China, Chile, California, and a number of other places within the next ten years, alongside tight CAFE standards in the US – the penetration of EVs should expand exponentially in these countries and regions, with spillover effects elsewhere

To date, however, necessary investments to make this a reality are not being made, and carmakers are not ramping up production capacity to the required levels. Moreover, recent EV sales are far below previous expectations. In addition, ongoing discussions among policymakers and between the automotive industry and governments increasingly point to a softening of existing regulations and a deferral of key policy targets

Reflecting on these developments, OPEC’s latest Outlook assumes continued growth in future EV sales, as well as a rising share in the global vehicle fleet. However, this is at a slightly lower rate than in past outlooks

As captured in the Table, OPEC expects the global EV fleet to increase by almost 600 million units between 2024 and 2050, from a base of around 54 million in 2024. OECD countries and China are set to play a major role in this expansion, accounting for around 260 million and 180 million of additional EVs in 2050, respectively. In comparison, all other countries combined are expected to add around 150 million EVs over the same period

As regards commercial electric vehicles, OPEC has said, without sizeable energy density improvements, they are assumed to play only a very minor role by 2050. However, natural gas vehicles (NGVs) are anticipated to be used more as an alternative, but the expectation is that will still have only a small share in the global fleet