Liquids / Oil Demand Forecasts

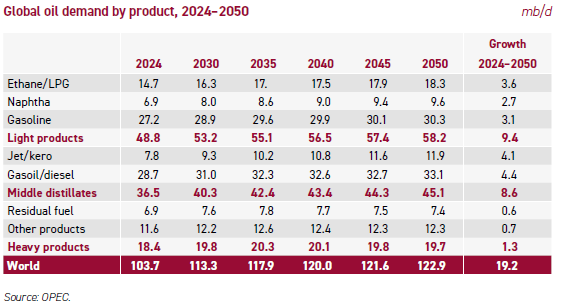

Table below captures IEA’s total liquids demand forecasts in the Current and Stated Policies scenarios

We explain the 2024 column in detail to clearly differentiate between crude oil, oil products and total liquids, so that readers will find it easy to understand the demand forecasts in the subsequent columns

In 2024, total liquids demand was 102.5 mb/d, of which 2.5 mb/d was met by biofuels, and 100 mb/d by oil. Of this, CTL, GTL and additives contributed 0.9 mb/d and direct use of crude oil was 0.9 mb/d, leaving 98.2 mb/d being met by oil products

The individual product contributions, LPG and ethane (14.6 mb/d), Naphtha (7 mb/d), Gasoline (25.4 mb/d), Kerosene (7.6 mb/d), Diesel (27.2 mb/d), Fuel Oil (6.4 mb/d) and other products (10 mb/d) add up to 98.2 mb/d. We would like to highlight that Aviation Turbine Fuel (ATF) is part of Kerosene

We would also like to highlight that not all these product quantities came from crude oil. NGLs contributed 13.1 mb/d and refinery products (derived from crude oil) contributed 85.1 mb/d, the two put together tallying with 98.2 mb/d

The Table in the next section gives IEA forecasts, excluding biofuels, so the starting point is 100 mb/d for 2024 (102.5 mb/d total liquids less 2.5 mb/d met by biofuels

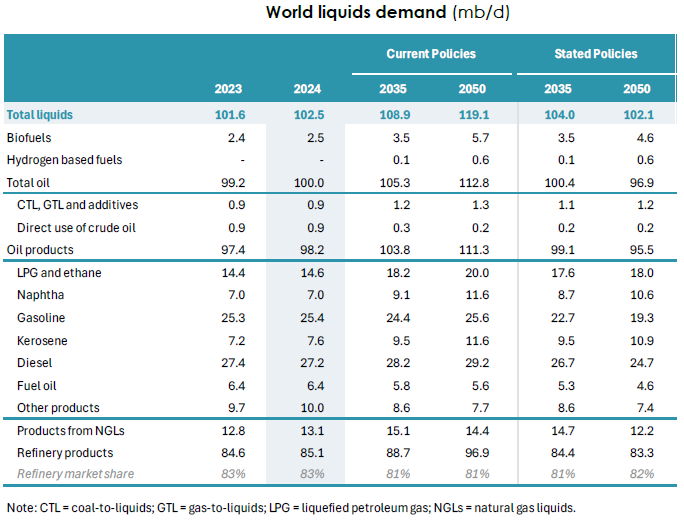

In Current Policies scenario, IEA expects oil demand, excluding biofuels, to rise by more than 5 million barrels per day (mb/d) to reach 105.3 mb/d in 2035, mainly because of increased use of oil in road transport in emerging market and developing economies, for aviation and shipping, and as petrochemical feedstock. In this scenario, oil demand continues to rise till 2050, reaching 112.8 mb/d. China accounted for more than 75% of oil demand growth over the past ten years, but this picture is changing, and India becomes the new epicentre of growth in oil demand

In the Stated Polices scenario, IEA expects global oil demand to increase from 100 mb/d in 2024 to a peak level of 102 mb/d around 2030. It then gradually falls, and by 2035 it is back to around its 2024 level, with notable reductions in demand from passenger cars and the power sector, more than offset by increases from petrochemicals, aviation and other industrial activities. Subsequently it is expected to fall by around 0.2 mb/d each year on average from 2035 to 2050, and drop to a level of 96.9 mb/d

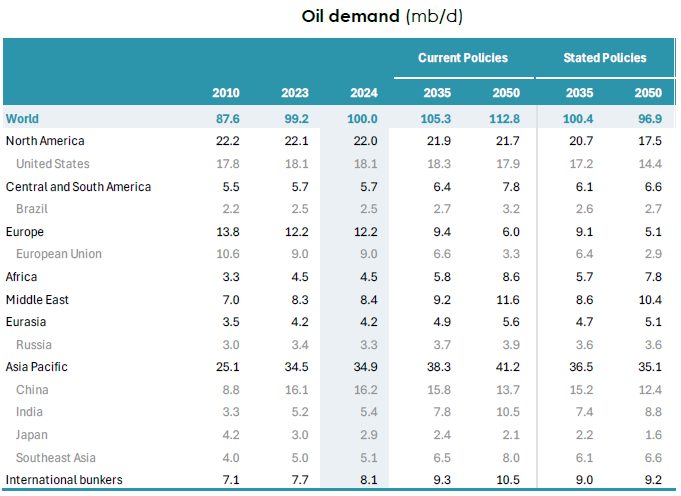

OPEC’s long term oil demand forecasts show overall global oil demand to increase from 103.7 mboe/d in 2024 to 122.9 mboe/d in 2050, an increase of 19.2 mboe/d

The two contrasting aspects of this overall forecast are a decrease in OECD demand by 8.5 mboe/d, but an increase in Non-OECD demand by 27.7 mboe/d, thus far outweighing decline in OECD demand

If we see the Growth column in the Table, India is expected to contribute 8.2 mboe/d to this demand growth, while China is expected to contribute 1.8 mboe/d

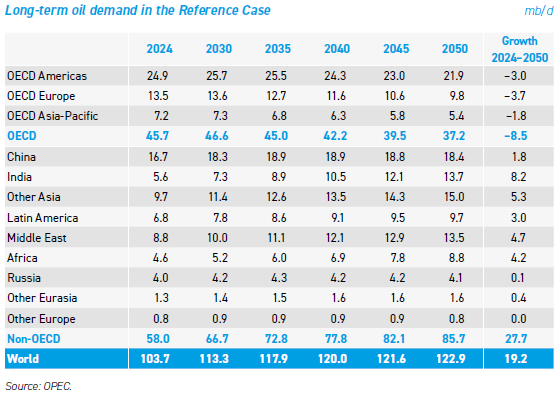

OPEC expects total oil demand to increase by 19.2 mb/d from 2024 to 2050, with product wise breakup as captured in the Table

At the product category level, Light and middle distillates are expected to drive most of the increase, while heavy refined products are set to witness only modest changes due to regulatory constraints and ongoing oil substitution by alternative energy sources

Amongst light products, ethane and LPG are expected to record the most significant increase, largely due to their expanding importance in the petrochemical sector

Naphtha demand is also projected to grow consistently over the outlook period, primarily to support ongoing industrialization and the expansion of the petrochemical sector in China, India and Other Asia

Gasoline demand is projected to rise from 27.2 mb/d to 30.3 mb/d, supported by increasing car ownership in regions such as India, Other Asia, Africa and Latin America, where EV adoption remains constrained by high costs and limited infrastructure

Middle distillates, including jet/kerosene and gasoil/diesel, are expected to see steady growth over the outlook period

Jet/kerosene demand is projected to increase by 4.1 mb/d, reaching 11.9 mb/d by 2050, driven by rising air travel in China, Other Asia and the Middle East. This growth is supported by the expansion of low-cost carriers and increasing air passenger volumes, underscoring aviation’s growing role in developing economies. Although SAF is anticipated to gain some market share in OECD countries, particularly after 2030, its high production costs and limited availability are likely to constrain its widespread adoption, preserving the dominance of conventional jet fuel

Diesel/gasoil demand is projected to rise from 28.7 mb/d to 33.1 mb/d, representing the largest absolute increase among all refined products, a gain of 4.4 mb/d over the outlook period. This growth reflects diesel’s essential role in commercial transport and industrial activity, supplemented by its use in other sectors, such as agriculture and residential etc.

OPEC expects relatively stable demand over the outlook period for heavy refined, with residual fuel oil continuing to serve as a critical input for industrial operations and maritime transport. However, its use in power generation is expected to decline steadily, driven by tightening environmental regulations and cost-competitive alternatives. Demand for residual fuel oil is forecast to peak at 7.8 mb/d around 2035, before gradually dropping to 7.4 mb/d by 2050, reflecting the impact of IMO regulations and its substitution in the power sector

Other refined products, including bitumen, petroleum coke, lubricants and waxes, are expected to see a minor demand increase, primarily supported by infrastructure development and industrial expansion in developing economies. In particular, bitumen consumption is expected to remain robust as governments in Asia and Africa continue to prioritize road and transportation projects