Negative Oil Price!

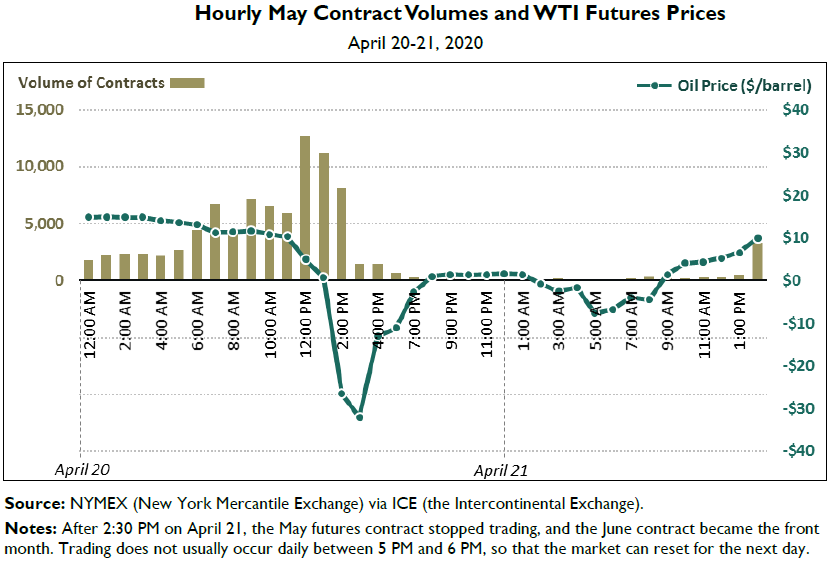

On April 20, 2020, something unthinkable happened: West Texas Intermediate (WTI) crude oil prices plunged to negative $37.63 per barrel, marking a historic first for the oil industry

This event was driven by a perfect storm of following factors:

- The COVID-19 pandemic had brought the global economy to a standstill, with travel bans, lockdowns, and reduced industrial activity slashing oil demand

- At the same time, oil production remained high due to delayed responses by major producers, leading to a glut of crude with nowhere to go. Storage facilities, particularly in Cushing, Oklahoma, the key delivery point for WTI, were nearly full, leaving traders with nowhere to put the physical oil they were obligated to take

- As the May futures contract approached its expiry date, traders scrambled to offload their positions, effectively paying buyers to take oil off their hands to avoid costly storage fees

This unprecedented negative pricing moment highlighted the vulnerabilities of the oil market and served as a wake-up call for the industry to rethink supply management, storage infrastructure, and the need for diversified energy sources

The experience also led to greater awareness among traders, making them less likely to allow contracts to approach expiration without proper risk management

Finally however, the unique set of conditions that caused negative prices in 2020 were quite extreme and unprecedented that they are widely considered a one-off anomaly and unlikely to occur again under normal circumstances

CRS on What does it mean?

We present below the observations from the Congressional Research Service (CRS) Report dated April 22, 2020

- The drop in overall crude oil prices, including the negative prices for the WTI May futures contract, indicates the market is working. According to economic theory, when the spread between supply and demand is as wide as it is now for crude oil, prices should fall significantly. The futures prices are in what industry refers to as contango: current prices are lower than future prices, which indicates a market sentiment that downward pressure on prices will continue until demand and supply come closer together and the storage constraint at Cushing is alleviated. Unless demand increases and consumers use more oil and petroleum products, the burden likely will fall on producers to reduce supply. Efforts by major oil producing nations and even U.S. state agencies to reduce production may provide some relief, but perhaps not immediately given the circumstances

- On April 21, the June WTI contract fell by 43% to $11.57 a barrel. Although still in positive territory, the drop, according to some analysts, may be indicative of lower prices to come. If Cushing storage capacity becomes physically full, there will be additional downward pressure on WTI futures contracts unless another event happens to mitigate the situation

- In the long-term, it is impossible to predict the ripple effect of these market conditions. Companies with limited capacity to adapt could default on debt obligations, reduce employment levels, or file for bankruptcy protection. Industry consolidation through mergers, acquisitions, and distressed asset transactions is also a possible outcome and may also produce further downward market pressure