Contribution to Exchequer: Central

(Data Source: PPAC)

Table below captures trend in the contribution of petroleum sector to the Central Exchequer. This is presented in two sub-sections, contribution from Taxes and Duties on Crude Oil & Peroleum Products, and contribution from Dividends & Income Tax

During 2024-25, total contribution to the Central exchequer was Rs 415,244 crore, comprising Rs 344,581.4 crore from Taxes and Duties on crude oil and petroleum products, and Rs 70,662.6 crore from Dividends and Income Tax

The single largest contributor to the central exchequer was Excise Duty, amounting to Rs 271,528.9 crore (~65% of total contribution to the central exchequer)

| Year | Cess on Crude Oil | Royalty on Crude Oil Natural Gas | Customs Duty | NCCD on Crude Oil | Excise Duty | Service tax | IGST | CGST | Others | Sub Total Central Taxes Duties Crude Products | Corporate Income Tax | Dividend income to Central Govt | Dividend distribution tax | Profit Petroleum on exploration of Oil Gas | Sub Total Dividends Income Tax | Total Contribution to Central Exchequer |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024-25 | 18559.1 | 9195.2 | 14337.0 | 1196.6 | 271528.9 | 19065.3 | 10653.4 | 45.9 | 344581.4 | 43244.8 | 22095.4 | 5322.4 | 70662.6 | 415244.0 | ||

| 2023-24 | 19580.4 | 9286.2 | 13133.7 | 1190.9 | 273683.9 | 20929.7 | 12230.1 | 51.5 | 350086.4 | 57493.3 | 19309.7 | 5504.7 | 82307.7 | 432394.1 | ||

| 2022-23 | 21444.7 | 9821.9 | 14985.3 | 1192.4 | 287575.3 | 22235.8 | 13011.6 | 59.4 | 370326.5 | 33291.8 | 15672.7 | 8776.1 | 57740.7 | 428067.1 | ||

| 2021-22 | 19213.6 | 5638.7 | 11423.4 | 1120.9 | 363305.0 | 19726.3 | 10843.3 | 337.6 | 431608.9 | 29219.3 | 22612.2 | 8862.1 | 60693.6 | 492302.5 | ||

| 2020-21 | 10676.3 | 3589.8 | 13514.2 | 1016.4 | 372970.0 | 0.3 | 11594.1 | 6157.7 | 365.2 | 419884.0 | 21908.9 | 10392.7 | 2883.5 | 35185.1 | 455069.0 | |

| 2019-20 | 14788.6 | 5602.0 | 22927.2 | 1130.2 | 223057.3 | 16.9 | 13098.6 | 6831.1 | 88.3 | 287540.3 | 23133.6 | 12270.1 | 5461.9 | 5909.1 | 46774.6 | 334314.8 |

| 2018-19 | 17740.8 | 6061.9 | 16035.3 | 1180.0 | 214369.4 | 339.7 | 16478.8 | 7436.9 | 203.9 | 279846.7 | 38560.6 | 15524.9 | 6415.3 | 7693.6 | 68194.4 | 348041.1 |

| 2017-18 | 14514.2 | 4746.7 | 11171.1 | 968.4 | 229715.9 | 1228.2 | 9211.2 | 4487.7 | 125.2 | 276168.5 | 33598.7 | 14575.3 | 5981.2 | 5839.1 | 59994.3 | 336162.8 |

| 2016-17 | 13081.8 | 4649.3 | 8798.5 | 926.4 | 242690.5 | 2955.9 | 122.2 | 273224.6 | 32511.2 | 17500.8 | 6196.6 | 5741.8 | 61950.4 | 335174.9 | ||

| 2015-16 | 15409.4 | 4885.4 | 6762.8 | 857.1 | 178476.8 | 2836.7 | 125.5 | 209353.8 | 25505.4 | 10217.4 | 4590.3 | 4630.0 | 44943.1 | 254296.9 | ||

| 2014-15 | 15869.3 | 3858.0 | 4124.9 | 822.3 | 99068.4 | 2180.9 | 101.1 | 126024.9 | 23920.9 | 9196.9 | 3500.2 | 9422.4 | 46040.5 | 172065.4 |

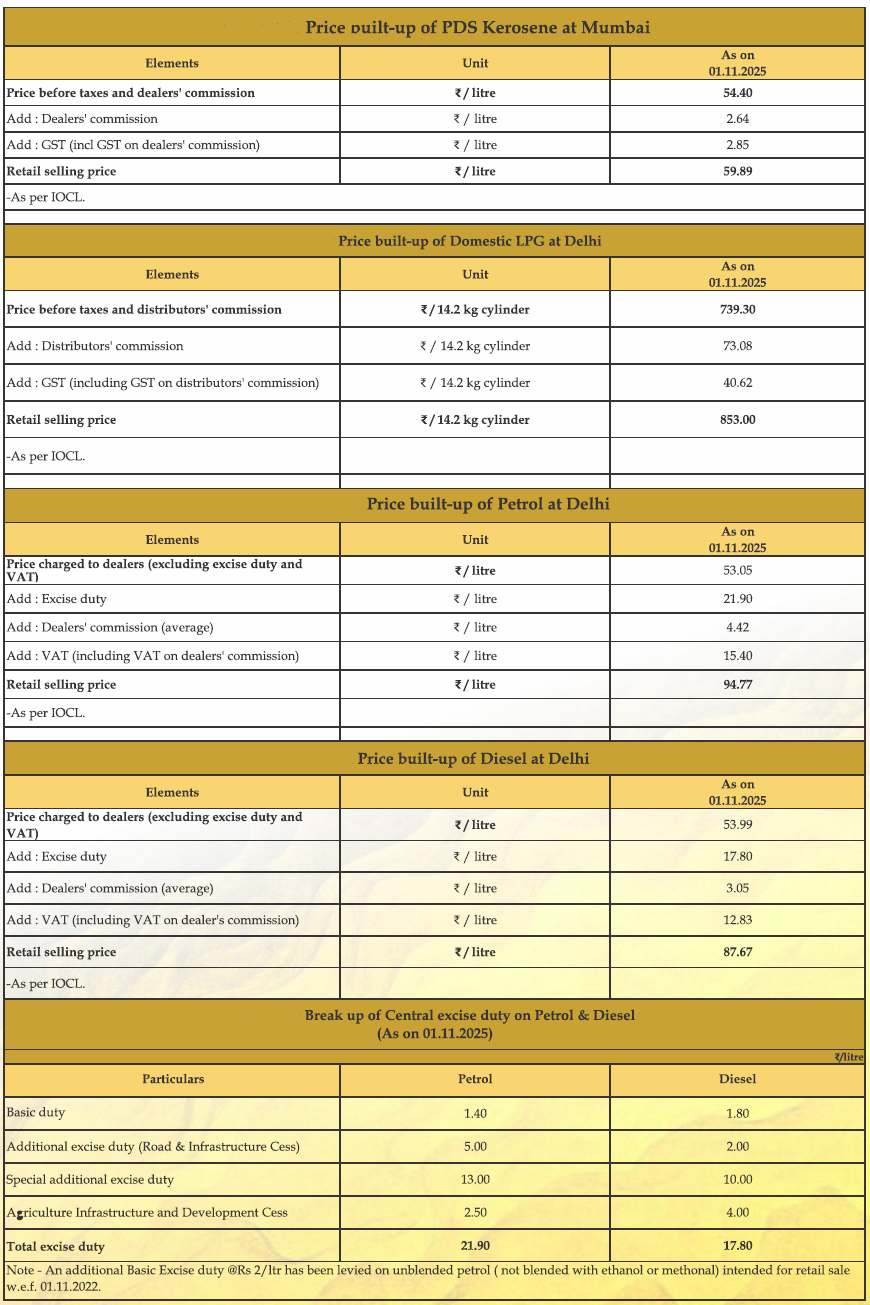

Price build-up of Petroleum Products:

Table below captures product-wise price build-up, including price before taxes and distributors’ commission / Distributor’s commission / GST (including GST on Dealer’s commission) and Retail selling price for PDS Kerosene and LPG, and including price charged to dealers (excluding excise duty and VAT) / Excise Duty / Dealer’s commission (average) / VAT (including VAT on Dealer’s commission) / and Retail selling price for Petrol and Diesel

These prices are at Delhi

For Petrol, we can see that Excise of Rs 21.9/litre accounts for ~21.3% of retail selling price and VAT of Rs 15.4/litre accounts for ~16.3% of retail selling price of Rs 94.77/litre. The two together, account for ~39.4% of retail selling price

For Diesel, we can see that Excise of Rs 17.8/litre accounts for ~20.3% of retail selling price and VAT of Rs 12.83/litre accounts for ~14.6% of retail selling price of Rs 87.67/litre. The two together, account for ~34.9% of retail selling price

Excise Duty accrues to the central government while VAT accrues to the respective state governments